What is a statutory annuity?

Annuities are fixed payments linked to a person's lifetime. Annuities and other benefits from statutory pension insurance, the agricultural pension fund, and professional pension schemes are only partially taxable, depending on the year the pension started.

If you have received a pension from statutory pension insurance, you can request a “Statement for submission to the tax office” regarding your pension income as a filling aid. This will then be sent to you automatically in subsequent years. If the pension started in 2020, the taxable portion is 80%.

No entries regarding the taxable portion are required in the tax return. The tax-free part of the pension is determined in the year following the start of the pension and generally applies for the entire duration of the pension. In subsequent years, this amount is deducted from the annual (gross) pension amount.

Pension increases based on regular adjustments are fully taxable. The same applies to benefits from private basic pension contracts (so-called Rürup pensions).

Annuities include in particular

- old-age pensions,

- disability pensions,

- incapacity pensions,

- occupational disability pensions,

- survivor's pensions such as widow's/widower's pensions,

- orphan's pensions, or

- parental pensions.

One-off payments, such as death benefits or settlements of small pensions, must also be declared. If you have been recognised as a victim of National Socialist persecution under § 1 of the Federal Compensation Act (BEG) and pension periods due to persecution were taken into account in the calculation of your statutory pension, please inform the tax office informally.

Such periods may have been considered under the Act on the Payment of Pensions from Employment in a Ghetto (ZRBG), the Act on the Settlement of National Socialist Injustice in Social Insurance (WGSVG), or the Foreign Pensions Act (FRG). This also applies to widow's/widower's pensions if the deceased was recognised as a victim under § 1 BEG and the pension includes corresponding pension periods. The tax office will check whether this pension is tax-free.

(2022): What is a statutory annuity?

How is the statutory pension taxed?

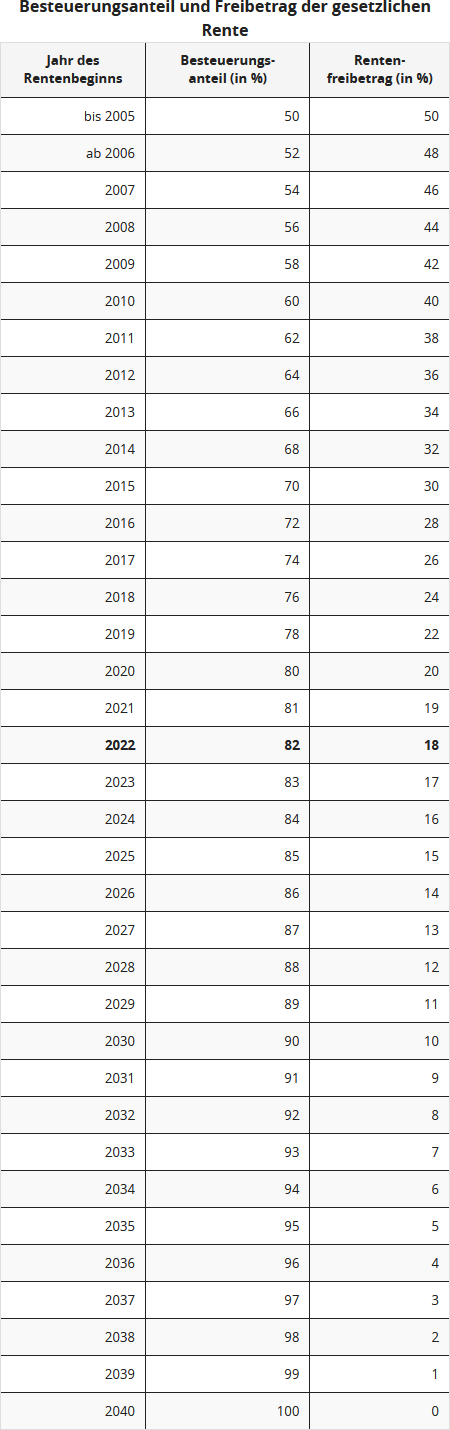

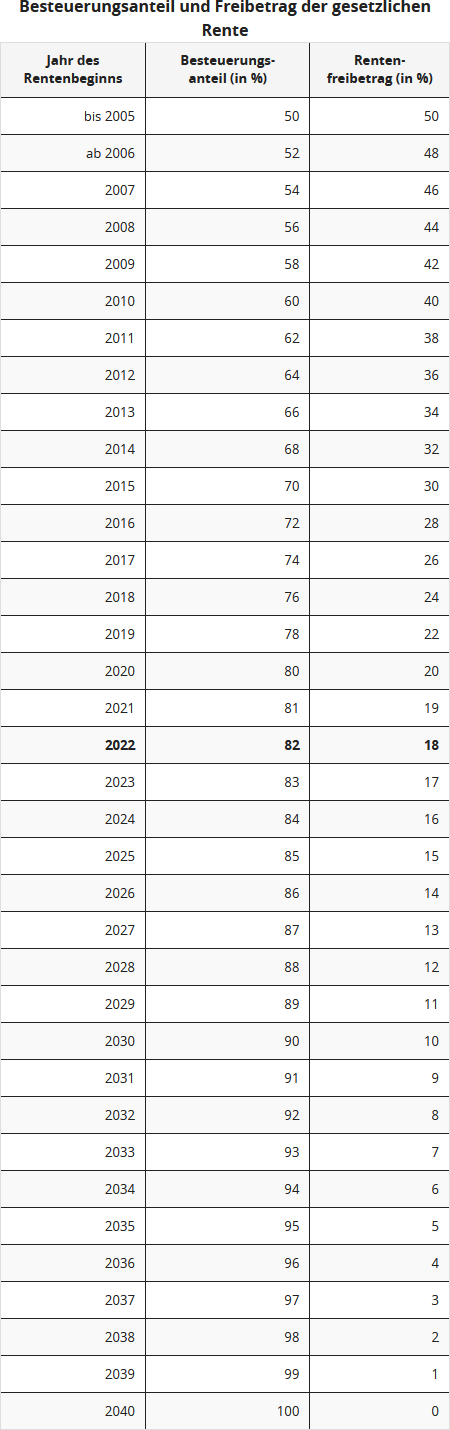

The legislator reformed the taxation of state pensions in 2005 with the Retirement Income Act. Since then, a fixed portion of the pension is taxable, while the rest remains (for now) tax-free. You must pay tax on your pension income; this is known as deferred taxation. The amount you need to tax depends on the year you started receiving your pension.

For individuals who retired in 2005 or earlier, the tax-free portion was 50 per cent. A (personal) allowance is created from the non-taxable pension, allowing these pensioners to use a "pension allowance" of 50 per cent from 2005 onwards. This pension allowance remains unchanged for life.

Since 2005, the so-called taxable portion has increased annually by two percentage points, and from 2021 by one percentage point per year. Thus, individuals retiring from 2040 onwards will have to fully tax their state pension income.

The tax office automatically deducts an allowance for advertising costs of 102 Euro without further proof. If you have higher expenses, you should declare them in your tax return to reduce your taxable income. You can declare, for example, tax consultancy costs (for form R), pension advice, or a lawyer if they support you with pension matters. However, you must prove the higher expenses in any case.

Example

Hans Müller retired on 1 January 2009 and received a state pension of 12.000 Euro last year. For Hans Müller, 58 per cent of his pension is taxable, and the pension allowance is 42 per cent. Thus, Müller would have to declare 6.960 Euro as income to the tax office for the year. However, if he has no other income, he does not have to submit a tax return, as the amount is below the basic allowance of 10.347 Euro (2022).

The lifelong pension allowance for Hans Müller is 5.040 Euro. However, he would only have to tax income above this allowance if it also exceeds the basic allowance.

Income from renting and leasing or capital gains must, however, be added to the income.

If Hans Müller were to receive a pension of 15.000 Euro and retire in 2022, he would have to tax 12.300 Euro (82 per cent) of his pension and therefore also submit a tax return.

Note: The pension allowance for Müller remains the same for life. Even if his pension income increases due to pension adjustments, only 5.040 Euro would be tax-free each year in the first example. The allowance refers to a specific amount of money, not a percentage of the respective pension. Thus, Mr Müller must fully tax future pension adjustments.

(2022): How is the statutory pension taxed?

Which income-related expenses can I claim as a pensioner?

Even as a pensioner, you can claim expenses related to your pension as income-related expenses in your tax return. If your income-related expenses total less than 102 Euro, it is not worth entering them. The tax office automatically applies an income-related expenses allowance of 102 Euro, which is immediately deducted from your income. This allowance is applied jointly for all pensions and all income that must be declared under other income. It is an annual amount that is not reduced, even if the conditions did not apply for the entire year or if there was no income for the whole year. The income-related expenses allowance is personal and is available to each spouse separately as soon as they have the relevant income.

Tip: If you have higher expenses exceeding the allowance of 102 Euro, it is definitely worth entering them. However, you should also have the evidence ready and enclose it with your tax return. If you have expenses for a tax advisor, the tax office will only recognise the costs as income-related expenses if they are related to your pension. Therefore, ask your tax advisor to specify separately in their invoice the part that directly relates to your pension.

Income-related expenses you can claim include, for example, expenses for a

- pension advisor,

- lawyer in pension disputes,

- tax advisor (only for form R), and also

- costs related to applying for a pension (travel expenses, office supplies, postage, telephone costs)

- court fees if the case concerns your pension

- union fees you pay as a pensioner

- flat-rate account maintenance fee of 16 Euro per year

Tip

If you are unsure whether the tax office will recognise a particular expense, simply declare it and enclose the evidence. The tax officer will decide.

(2022): Which income-related expenses can I claim as a pensioner?

What does the 2005 Retirement Income Act regulate?

The Pension Income Act regulates the taxation of pensions. It affects everyone, both pensioners who were already retired in 2005 and all future retirees. The tax burden for new pensioners increases year by year - at the same time, the benefits for employees also grow.

Tax-advantaged pension provision

In addition to the statutory pension insurance, private pension insurance is also recognised as a pension provision (so-called basic pension or Rürup pension). Contributions to private pension insurance are only tax-advantaged if the insurance is aimed at a lifelong pension for the taxpayer. In addition, the insured person must be at least 60 years old when the pension payments begin. For contracts concluded from 2012 onwards, pension payments may not begin until the age of 62. This ensures that they are pension provision products. Furthermore, pension entitlements must not be transferable, pledgeable, sellable, or capitalisable. The insurance sum must also be paid out as an annuity; lump-sum payments are generally prohibited. However, tax-advantaged pension products can be supplemented with additional insurance - for example, occupational disability insurance.

Investment products that do not necessarily serve as pension provision are not tax-advantaged. These are usually freely available capital investments, which also include endowment life insurance. An exception is endowment life insurance policies concluded before 2005. They remain tax-free.

For pensioners, this means the following:

Since 2005, 50 per cent of pension income has been taxable. From 2006 to 2020, the taxable portion of pensions increases by two percentage points annually, and from 2021, the portion increases by only one percentage point per year. In 2040, the pension will be 100 per cent taxable, whereas employee contributions to pension provision will then be largely tax-free.

Also regulated in the Pension Income Act: Temporary pensions, such as disability pensions, and non-temporary pensions, such as old-age pensions, have been treated equally for tax purposes since 2005. Pensions from insurance policies that are tax-advantaged during the accumulation phase are taxable during the payout phase.

Note:

At the end of May 2021, the Federal Fiscal Court published its two rulings on the possible double taxation of pensions. However, the lawsuits filed by the affected pensioners were unsuccessful. The Federal Fiscal Court considers double taxation to be possible only in a few individual cases. It considers the basic system of pension taxation to be lawful, i.e. the limited deduction of pension expenses during working life, combined with the partial tax exemption of pensions during the payout phase. Double taxation is only likely to occur for later generations of pensioners (Federal Fiscal Court rulings of 19.5.2021, X R 33/19 and X R 20/21). However, the unsuccessful plaintiffs have lodged a constitutional complaint against the two decisions of the Federal Fiscal Court (Ref. 2 BvR 1143/21 and 2 BvR 1140/21).

The issue is how double taxation is calculated in detail. The Federal Fiscal Court has taken a very schematic view, which only leads to excessive taxation of pensions in individual cases. For the calculation of possible double taxation, the nominal value principle applies. In simple terms, the actual contributions paid and subsidised pension expenses are to be compared with the actual pension payments received, which are partially exempt. Neither amounts are to be discounted or compounded, nor is inflation to be taken into account.

However, some experts, as well as the plaintiffs in case X R 33/19, argued that during the working phase, no pension amounts are acquired in cash, but rather pure pension points. The actual amount of the pension only becomes clear much later. However, the Federal Fiscal Court did not delve into the "depths" of financial and insurance mathematics but compared contributions paid with payments received. Whether this is correct or whether there is a more favourable calculation for taxpayers is to be clarified by the constitutional judges in Karlsruhe.

The federal and state governments have now finally agreed to issue affected tax assessments on a provisional basis regarding the disputed point. Specifically, tax assessments are issued provisionally with regard to the "taxation of annuities and other benefits from basic provision under section 22 number 1 sentence 3 letter a double letter aa EStG". The provisional note is attached to all income tax assessments for assessment periods from 2005 onwards in which an annuity or other benefit from the so-called basic provision is recorded (BMF letter of 30.8.2021, V A 3 - S 0338/19/10006 :001).

This means that pensioners will now receive income tax assessments with a note on the - partial - provisional nature of the tax assessment. If the Federal Constitutional Court finds that the current taxation of statutory pensions and pensions from occupational pension schemes and similar pension schemes is unconstitutionally high, the tax assessments issued now and in the future can be amended without a prior objection.

(2022): What does the 2005 Retirement Income Act regulate?

What does the opening clause mean?

With deferred taxation, there can be unfair over-taxation if a self-employed person has paid contributions to an occupational pension scheme over several years that were higher than the annual maximum contribution in the statutory pension insurance (sum of employer's and employee's share). The maximum amount to be paid is based on the contribution assessment ceiling.

This is recalculated annually and represents the limit up to which pension insurance contributions must be paid as a proportion of income. For income above the contribution assessment ceiling, you usually do not pay insurance contributions – unless you pay them voluntarily as in this context.

The self-employed person has therefore voluntarily paid additional contributions from their already taxed income. As a result, they have earned a higher pension, but on the other hand, they would have to tax it too highly with the usual tax rate. This can be avoided. As a pensioner, they can have their pension divided into a voluntary and a statutory part. However, they must have paid a higher voluntary contribution for at least ten years by 31.12.2004.

Tip

If this applies to you, you must apply for the portion of your pension based on these increased contributions to be taxed not at the high tax rate (2022: 82 percent of the pension) but at the significantly more favourable income share. The portion of the pension to be taxed at a lower rate is the opening clause, which you can find in the certificate from your pension insurance provider.

Example

If you have been receiving a statutory pension of 1.500 Euro per month since the age of 65 and can prove to the tax office with a certificate from the pension payment office that 30 percent (this is the opening clause) of the pension payment is based on increased contributions, the following calculation applies:

For 70 percent of the pension: Normal taxation after deduction of the pension allowance: 1.500 Euro x 70 percent = 1.050 Euro x 12 months = 12.600 Euro minus pension allowance of (for example) 42 percent = 7.308 Euro.

For the part for which the opening clause of 30 percent applies, the more favourable income share is applied: 1.500 Euro x 30 percent = 450 Euro x 12 months = 5.400 Euro x 18 percent = 972 Euro. In this case, 8.280 Euro would have to be taxed. Without the opening clause, 10.440 Euro would have had to be taxed.

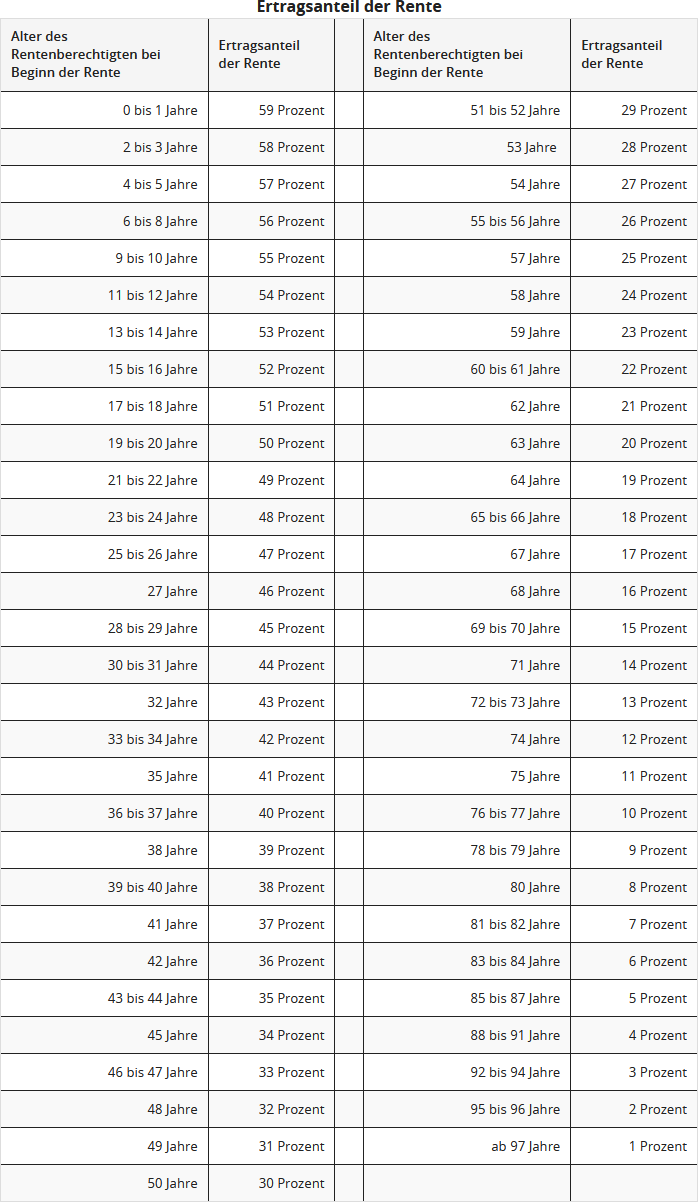

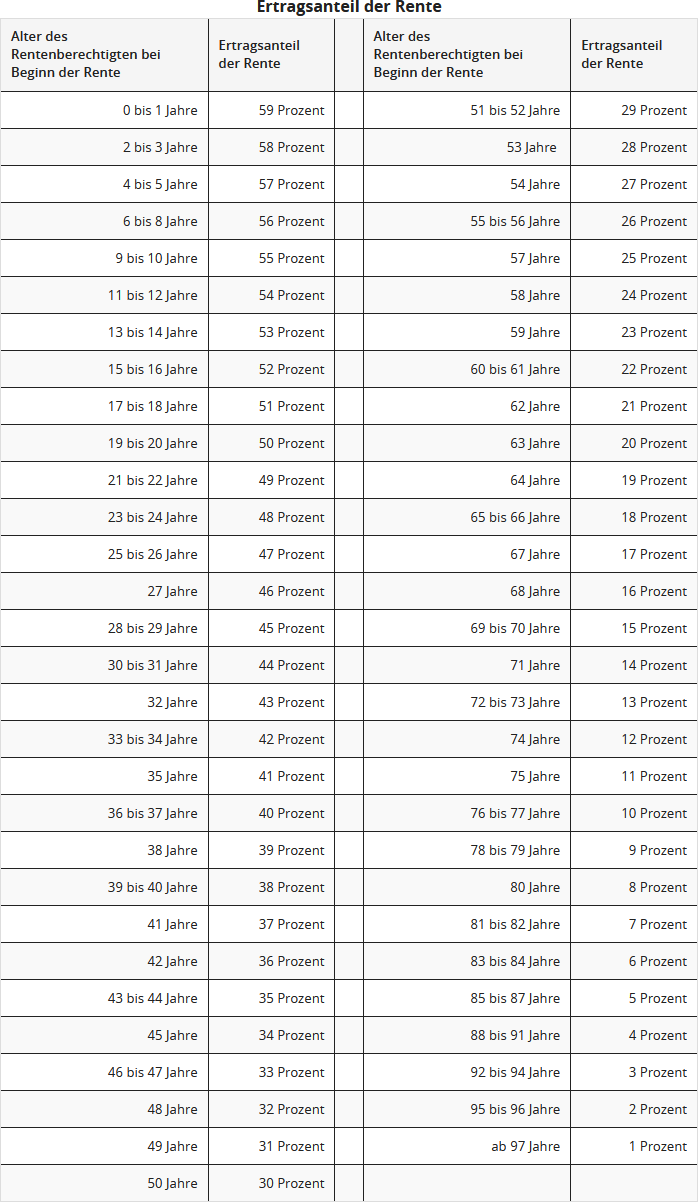

The income share depends on the age of the pensioner at the start of the pension payment, for example, it is 19 percent for 64-year-olds, 18 percent for 65 to 66-year-olds, and 17 percent for 67-year-olds.

The following table shows the amount of the income share depending on the age at the start of the pension; this is automatically calculated by Lohnsteuer kompakt:

Note:

At the end of May 2021, the Federal Fiscal Court published its two rulings on the possible double taxation of pensions. However, the claims of the affected pensioners were unsuccessful. The BFH considers double taxation to be possible only in a few individual cases. It considers the basic system of pension taxation to be lawful, i.e. the limited deduction of pension expenses during working life, combined with the partial tax exemption of pensions during the payout phase. Double taxation is only expected for later pension cohorts (BFH rulings of 19.5.2021, X R 33/19 and X R 20/21). However, the unsuccessful plaintiffs have lodged a constitutional complaint against the two BFH decisions (Ref. 2 BvR 1143/21 and 2 BvR 1140/21).

The issue is how double taxation is calculated in detail. The BFH has taken a very schematic view, which only leads to excessive taxation of pensions in individual cases. For the calculation of possible double taxation, the nominal value principle applies. In simple terms, the actual contributions paid and benefited from must be compared with the actual pension payments received and partially exempted. Neither amounts are to be discounted nor is inflation to be taken into account.

However, some experts, as well as the plaintiffs in case X R 33/19, argued that during the working phase, no pension amounts are acquired in cash, but rather pure pension points. The actual amount of the pension only becomes clear much later. But the BFH did not delve into the "depths" of financial and insurance mathematics, but rather compares amounts paid in with amounts paid out. Whether this is correct or whether there is a more favourable calculation for taxpayers is to be clarified by the constitutional judges in Karlsruhe.

Currently, the federal and state governments have finally been able to agree to issue affected tax assessments on a provisional basis regarding the disputed point. Specifically, tax assessments are issued provisionally regarding the "taxation of annuities and other benefits from basic provision under § 22 number 1 sentence 3 letter a double letter aa EStG". The provisional note is attached to all income tax assessments for assessment periods from 2005 in which an annuity or other benefit from the so-called basic provision is recorded (BMF letter of 30.8.2021, V A 3 - S 0338/19/10006 :001).

This means that pensioners will now receive income tax assessments with a note on the - partial - provisional nature of the tax assessment. If the Federal Constitutional Court finds that the current taxation of statutory pensions and pensions from occupational pension schemes and similar pension schemes is unconstitutionally high, the tax assessments issued now and in the future can be changed without a prior objection.

(2022): What does the opening clause mean?