Field help

Gifts

Enter here the non-deductible and the deductible expenses for gifts.

Gifts to business associates: Gifts are deductible as business expenses, provided the expenditure per person and year does not exceed 35 Euro. The amount of 35 Euro applies to entrepreneurs subject to VAT without VAT and to entrepreneurs not subject to VAT (small businesses, doctors) including VAT. Costs for labeling the gift as an advertising medium are included when determining the limit, but not shipping and packaging costs.

The 35 Euro limit is not an allowance, but an exemption limit: If the costs exceed the amount of 35 Euro per person, they are not deductible as business expenses in total. These non-deductible amounts must also be entered in this line.

Note: You must record the expenses for gifts individually and separately from the other business expenses or enter them in a separate account.

Lohnsteuer kompakt: The limit of 35 Euro does not apply if the recipient can only use the gift in their business (R 4.10 para. 2 sentence 4 of the Income Tax Regulations (EStR)). Business-related gifts to employees are fully deductible and must be entered.

Hospitality costs

List the non-deductible and the deductible hospitality costs here.

When it comes to hospitality expenses, the tax authorities distinguish between hospitality for "business" reasons and hospitality for "general company" reasons. This affects the degree to which the costs are recognised for tax purposes:

- A business occasion exists for entertaining people outside the company with whom business relationships already exist or with whom they are to be initiated. This also includes visitors to the company, as well as employees of affiliated companies and persons comparable with them i.e. specialist colleagues. The same applies to freelancers and sales representatives. Only 70 % of these hospitality costs are deductible and 30 % are non-deductible. Therefore, the costs must be divided accordingly and both amounts entered here.

- A general company occasion covers hospitality to entertain a company's own employees i.e. people working in-house at the company. "Company" occasions also apply to the expenses incurred by a beverage wholesaler for rounds of drinks paid for at its customers' restaurants/pubs and for customer drinks at breweries. In this case, the costs are 100 % deductible and must therefore be entered in full on the "Other fully deductible business expenses" page. According to the Federal Fiscal Court, the above-mentioned restriction on deductions for hospitality expenses does not apply if a coach driver stops at a service station restaurant and is catered for without charge for "bringing paying customers" (Federal Fiscal Court (BFH) judgement of 26.04.2018, X R 24/17)

Lohnsteuer kompakt: Expenditure for hot and cold beverages, biscuits etc. during company meetings are so-called "courtesies" and can be declared in full as business expenses, deductible on the page "Other fully deductible business expenses".

Lohnsteuer kompakt: The VAT included in the hospitality costs is fully deductible as business expenses and must also be entered under "VAT already paid on goods/services" on the "Other fully deductible business expenses" page.

Note: You must specify the hospitality costs individually and separately from the other business expenses or enter them in a separate account.

Other business expenses

Enter here the non-deductible and deductible expenses for other deductible business expenses.

Entertainment costs

Expenses that relate to the (private) lifestyle of the taxpayer or other persons are generally not deductible as business expenses.

Entertainment costs incurred for business purposes are only deductible "if they are not deemed unreasonable in accordance with the customary understanding of the trade" (sect. 4 para. 5 no. 7 Income Tax Act (EStG)).

Fines, administrative fines, warning fines or monetary penalties

Such fines imposed by courts or authorities in Germany or by the European Communities institutions are not deductible as business expenses. However, this does not apply to fines imposed by courts or authorities of other states outside the European Communities.

Fines imposed as a result of criminal proceedings are not deductible. Fines imposed by a foreign court may be deductible as business expenses if they contradict essential principles of the German legal system.

Total limited deductible business expenses

The total of non-deductible and deductible operating expenses and business tax is transferred to the overview page "business expenses" to determine the sum of business expenses.

Aufwendungen für ein häusliches Arbeitszimmer (einschließlich AfA und Schuldzinsen)

Enter here the non-deductible and deductible expenses for your home office.

Expenses for a home office or working room may be deductible as business expenses, as follows

- in unlimited amount, if it represents the centre of your entire operating and professional occupation.

- up to 1.250 Euro if no other workplace is available for the operational or professional occupation.

A home office may also continue to be deductible in unlimited amounts as business expenses in the following cases:

- It is not a "domestic" home office: rooms that are not integrated into the domestic sphere and do not form a structural unit with the living area are not considered "domestic". Examples: Renting a home office in another house, additionally rented rooms in a multiple-family house on another floor than the private flat.

- It is not a "home office": rooms which are not typical of a home office in terms of equipment and function are not considered "home offices", even if they are situated in the household area. Examples: Workshop, storage room, exhibition room, salesroom, a recording studio with a composer, studio with a painter, lawyer's office, practice rooms of a language teacher, emergency practice of a doctor.

- The home office is open to extensive and permanent public traffic: In this case, the office is not a home office in terms of its function.

- There are other employees in the home office: In these cases, the room is not considered to be a home office by its nature.

If you have the personal and material requirements for the tax recognition of a domestic home office, enter all expenses for the home office here.

The Corona pandemic has changed the world of work. Many employees, but also the self-employed, therefore carry out their professional or business activities at home (home office). However, they do not always have a separate room that is accepted as a workroom for tax purposes. Normally, expenses for a home office are only recognised as income-related expenses or business expenses for tax purposes if it is a separate room in the home and is used exclusively or almost exclusively for professional or business purposes.

But even those who do not have a separate room incur expenses for heating, electricity or water as a result of their work at their home workplace. And now they will also receive tax relief: in the period from 1 January 2020 to 31 December 2022, employees and self-employed persons who work at home and whose workplace does not meet the tax requirements for a workroom can claim a flat-rate amount of 5 Euro per day as income-related expenses or business expenses. A maximum of 600 Euro per year is deductible.

Additional meal expenses

Enter here the deductible meals allowances incurred in connection with external work, business trips or double household running for company-related reasons.

- Travel expenses to be indicated separately on the page "Vehicle costs and other travel expenses".

- Accommodation costs and additional travel expenses must be entered on the page "Other unlimited deductible business expenses".

- Travel expenses for employees are entered on the page "General operating expenses" under "Expenses for own personnel".

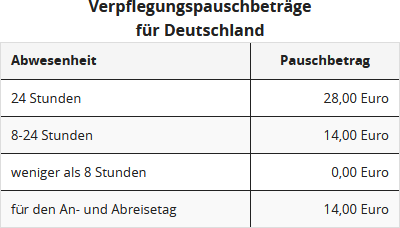

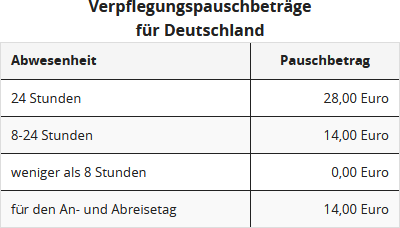

You can only deduct a flat-rate amount for additional meals expenses, not the actual costs. The amount of the flat rates depends on the duration of your absence from your home and company. The meal allowance for business trips within Germany with an absence duration of

For business trips abroad, you can deduct the country-specific meal allowances.

If an external work assignment begins on one day and ends on the following day after more than 8 hours without overnight accommodation, a meal allowance of 14 Euro is granted for the day with the prevailing absence (sect. 9 para. 4a no. 3 of the Income Tax Act (EStG)).