CURRENT: Summer 2021 storms

On 14 and 15 July 2021, a flood disaster of historic proportions with devastating effects occurred in Rhineland-Palatinate - particularly in the Eifel - and in North Rhine-Westphalia. On 17 July, parts of Bavaria and Saxony were also affected. Almost 200 people lost their lives. The low-pressure system "Bernd" caused damage amounting to billions. Numerous places have been devastated and partially destroyed, countless people are left with nothing, having lost their belongings and seeing only the ruins of their existence. The damage is indescribably large. Its repair leads to extraordinarily high financial burdens. The tax authorities want to help those affected and their supporters with various tax relief measures.

In the case of natural disasters that devastate entire regions, the tax authorities provide tax relief for those affected, which they implement on a case-by-case basis with the so-called "disaster decree". This is also the case with the current flood disaster.

Currently, the finance ministries of the affected states of Rhineland-Palatinate, North Rhine-Westphalia and Bavaria have decided on tax relief for those affected by floods, high water and flooding. In particular, expenses for the replacement of furniture, household items and clothing as well as for the repair of damage to owner-occupied houses can be deducted as extraordinary expenses in accordance with § 33 EStG.

In principle, a tax deduction is not possible if those affected have failed to take out a "generally accessible and customary insurance option" (R 33.2 No. 7 EStR). This includes in particular household and residential building insurance. However, these insurances only cover damage caused by flooding if elemental damage insurance is also included. Therefore, if the risk of damage could have been covered by such insurance, a tax deduction is actually not possible. In fact, however, many flood damages are not insured because those affected did not take out elemental insurance, could not obtain such insurance, or the insurance is not sufficiently high.

Since the tax deduction for household goods, clothing and building damage in the event of natural disasters is provided for in the disaster decree and this decree represents an equity regulation according to § 163 AO, the requirement of the customary insurance option should be disregarded in this case.

Lohnsteuer kompakt

The finance ministries of the affected states have stated that "so-called elemental insurance is not a generally accessible and customary insurance option within the meaning of R 33.2 No. 7 EStR" (as already stated in the BMF letter of 21.6.2013, BStBl 2013 I p. 769, No. VI). Therefore, the tax offices are instructed not to refuse the recognition of damage costs due to flooding and inundation because of a lack of elemental insurance.

Here are some tax tips:

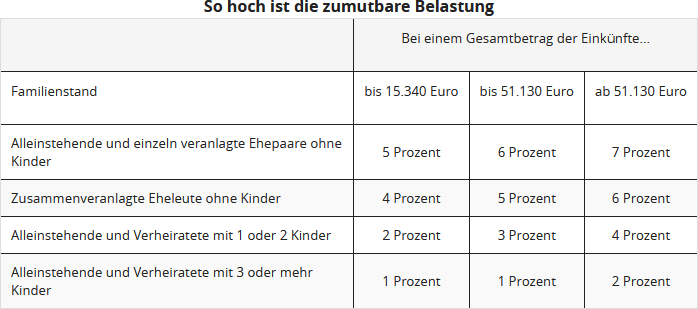

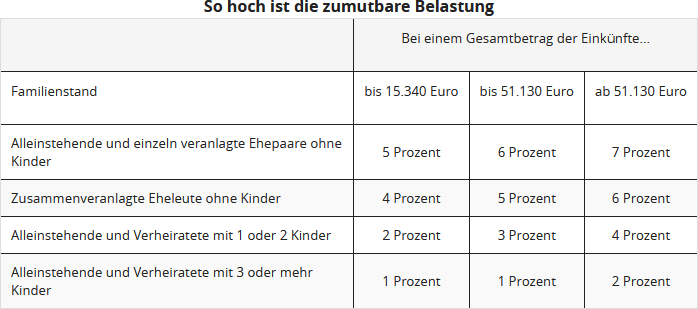

- For your expenses for the replacement of furniture, household items and clothing as well as for the repair of damage to owner-occupied houses, the tax office deducts a reasonable burden, which depends on the amount of your income, the number of children and your marital status. It amounts to between 1 and 7 percent of the total income. If this reasonable burden is exceeded, every further euro has a tax-reducing effect. Therefore, it is now particularly worthwhile to meticulously collect all receipts for medical expenses, for doctors and pharmacies, etc.!

- For craftsmen's services, you can claim the direct tax deduction according to § 35a EStG. You can deduct the labour costs as well as invoiced machine and travel costs plus the VAT on them up to 6,000 Euro at 20 %, maximum 1,200 Euro, directly from the tax liability. Make sure that you get an invoice and pay it by bank transfer only. If you claim craftsmen's services as extraordinary expenses, you can deduct the reasonable burden at 20 %, maximum 1,200 Euro, directly from the tax liability.

- Always claim your expenses in the year they are incurred in the tax return. Even if you have taken out a loan to pay for them. You can also deduct the ongoing interest on the loan - but not the repayment instalments - as extraordinary expenses in subsequent years.

- If you finance the damage costs with funds you received as a gift, you can still deduct your expenses as extraordinary expenses and do not have to offset the gifted funds against them (BFH ruling of 22.10.1971, BStBl 1972 II p. 177).

- Without waiting for the tax return, employees can have the expenses deductible as extraordinary expenses entered early at the tax office as a allowance for the monthly wage tax deduction. The entry is made in your electronic wage tax deduction features. This reduces the wage tax every month and increases the net income accordingly. Use the form "Application for wage tax reduction" for this purpose.

In addition to the aforementioned tax benefits, a whole range of other tax relief measures are planned. In addition, other federal states have also issued equity regulations for aid measures.

Even beyond the major disaster areas, severe local weather has caused significant damage. And here the question arises as to the extent to which homeowners can claim the costs of repairing the damage for tax purposes, i.e. in cases where the disaster decrees do not apply directly.

First, the principle: You can claim expenses for the repair of damage to your home due to an "unavoidable event" as extraordinary expenses according to § 33 EStG, insofar as these are not covered by insurance. There is no upper limit for the tax deduction, but you must bear a reasonable burden of between 1 and 7 percent - depending on income and marital status. The following conditions apply for tax consideration:

- The damage must have been caused by an unavoidable event: Unavoidable events include fire, flooding, storm, hail, earthquake, lightning strike, landslide, snow pressure, war, expulsion or political persecution, plane crash, avalanche, reactor accident, sudden flooding, backwater (BFH 6.5,1994, III R 27/92; BFH 29.3.2012, VI R 70/10).

- The damage must affect an existentially important area: An "existentially important area" is the home. Damage to, for example, cars, garages or outdoor facilities or damage to terraces is not taken into account.

- There must be no indications of personal fault: In the case of damage caused by "unavoidable events", such as natural disasters, personal fault is ruled out in any case.

- Realizable claims for compensation must not exist: Expenses are not unavoidable "if they can be averted by making use of other compensation options, provided that their use is not exceptionally unreasonable" (BFH ruling of 20.9.1991, BStBl 1992 II p. 137).

- There is no customary insurance option for the risk of damage: In principle, a tax deduction is not possible if those affected have failed to take out a "generally accessible and customary insurance option" (R 33.2 No. 7 EStR). This includes in particular household and residential building insurance. However, these insurances only cover damage caused by flooding if elemental damage insurance is also included. Therefore, if the risk of damage could have been covered by such insurance, a tax deduction is actually not possible. In fact, however, many flood or backwater damages are not insured because those affected did not take out elemental insurance.

Tip

If your tax officer actually comes up with this argument, you can counter as follows: This restriction does not apply to those affected by a storm disaster. The tax authorities have long agreed that "so-called elemental insurance is not a generally accessible and customary insurance option within the meaning of R 33.2 No. 7 EStR" (BMF letter of 1.10.2002, BStBl 2002 I p. 960; also BMF letter of 6.9.2005, BStBl 2005 I p. 860). The tax offices are therefore not allowed to reject the expenses due to a lack of elemental insurance.

Even in the case of insured or insurable damage, a tax deduction may be considered, for example, in the amount of an excess or for damage costs exceeding the insurable maximum amount.

Problem of underinsurance: The Cologne Fiscal Court did not recognise an excess due to underinsurance as an extraordinary expense. "Because it cannot make a difference whether someone has not taken out any insurance at all or only insufficient insurance" (Cologne Fiscal Court of 20.12.2000, EFG 2001 p. 438).

For craftsmen's services, you can claim the direct tax deduction according to § 35a EStG. You can deduct the labour costs as well as invoiced machine and travel costs plus the VAT on them up to 6,000 Euro at 20 %, maximum 1,200 Euro, directly from the tax liability. Make sure that you get an invoice and pay it by bank transfer only.

Damage to rented houses and flats is not deductible as extraordinary expenses, but as income-related expenses for rental income. In this case, the above-mentioned conditions of the "unavoidable event" and the "existentially important area" do not apply. For the self-employed and business owners, the expenses for business premises are business expenses.

(2022): CURRENT: Summer 2021 storms

Natural disasters: tax relief for victims

Repeatedly, heavy rainfall and the associated flooding have caused considerable damage. Many people are left with nothing, having lost their belongings and seeing only the remnants of their existence. The damage repair will lead to significant financial burdens.

Almost always, the finance ministries of the affected federal states decide in these cases to assist those affected through tax measures to avoid undue hardship. The so-called disaster decree is then regularly enacted, granting tax relief and reductions.

In particular, those affected can deduct expenses for the replacement of furniture, household items, and clothing, as well as for damage repair to their own home as extraordinary expenses in accordance with § 33 EStG.

Lohnsteuer kompakt

Since the tax deduction for household items, clothing, and building damage in natural disasters is provided for in the disaster decree and this decree represents an equity regulation according to § 163 AO, the usual insurance requirement should exceptionally be disregarded here. The Federal Ministry of Finance already stated in 2013 that "so-called elementary insurance does not constitute a generally accessible and usual insurance option within the meaning of R 33.2 No. 7 EStR" (BMF letter of 21.6.2013, No. VI). Therefore, tax offices are instructed not to refuse the recognition of damage costs due to flooding and inundations because of a lack of elementary insurance.

Here are some important tax tips:

- For your expenses for the replacement of furniture, household items, and clothing, as well as for damage repair to your own home, the tax office calculates a reasonable burden, which depends on the amount of your income, the number of children, and your marital status. It amounts to between 1 and 7 percent of the total income. If this reasonable burden is exceeded, every additional euro reduces taxes. Therefore, it is particularly worthwhile now to meticulously collect all receipts for medical expenses, doctors, and pharmacies!

- For damage repair to your home, you can claim the direct deduction for craftsman services according to § 35a EStG for the part of the expenses not considered as extraordinary expenses due to the reasonable burden. This means: Costs up to 6.000 Euro are directly deducted from the tax liability at 20%, a maximum of 1.200 Euro. However, only labour costs and any invoiced machine and travel costs plus the applicable VAT are considered here. ATTENTION: It is assumed in your favour that this partial amount primarily relates to wages (BMF letter of 9.11.2016, BStBl. 2016 I p. 1213, para. 32). Be sure to get an invoice and pay it only by bank transfer!

- Always claim your expenses in the year they were incurred in the tax return. Even if you took out a loan to pay. The ongoing interest for the loan - but not the repayment instalments - can also be deducted as extraordinary expenses in subsequent years.

- If you finance the damage costs with funds you received as a gift, you can still deduct your expenses as extraordinary expenses and do not need to offset the gifted funds against them (BFH ruling of 22.10.1971, BStBl. 1972 II p. 177).

- Without waiting for the tax return, employees can have the expenses deductible as extraordinary expenses entered early at the tax office as an allowance for the monthly wage tax deduction. The entry is made in your electronic wage tax deduction features. This reduces the wage tax every month and increases the net income accordingly. Use the form Application for wage tax reduction 2022/2023.

(2022): Natural disasters: tax relief for victims

How to calculate the reasonable burden!

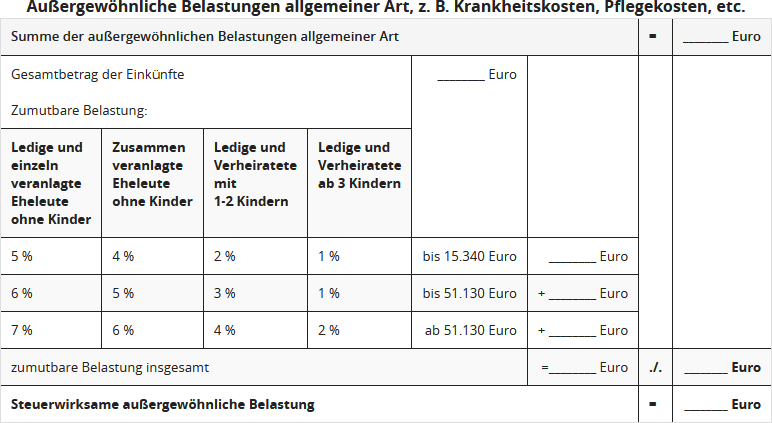

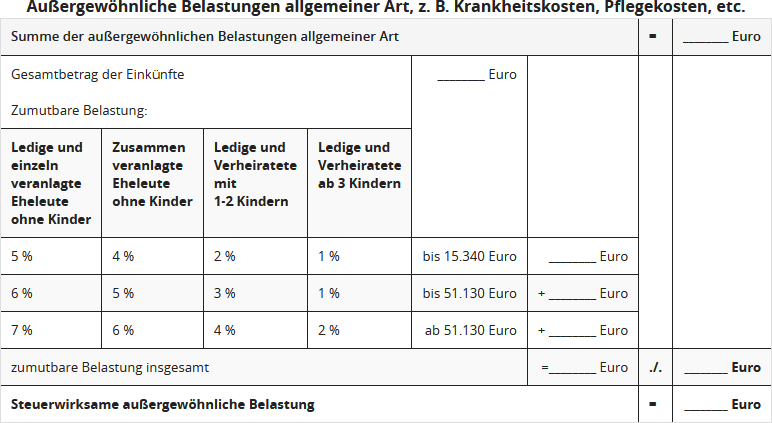

The expenses that can be deducted as extraordinary burdens are reduced by the reasonable burden, particularly medical, spa, care, and disability costs. The reasonableness limit is determined in three stages (Stage 1 up to 15,340 Euro, Stage 2 up to 51,130 Euro, Stage 3 over 51,130 Euro) based on a certain percentage of the "total income". This is between 1 and 7%, depending on family status and number of children.

- According to previous legal regulations, the total amount of the reasonable burden is determined by the higher percentage as soon as the total income exceeds one of the above limits. The higher percentage is then applied to the "total income".

- In January 2017, the Federal Fiscal Court took a closer look at the law and surprisingly found that the reasonable burden had been calculated completely incorrectly. The legally specified percentage does not refer to the "total income" but only to the part of the "total income" that exceeds the respective stage limit amount. For example, the percentage for Stage 3 only applies to the portion of income exceeding 51,130 Euro. The corresponding reasonable burden must be determined for each stage limit amount, and the amounts determined are then added together (BFH ruling of 19.1.2017, VI R 75/14).

The changed calculation method is already taken into account in the automated issuance of income tax assessments, and old assessments are also corrected if still legally permissible (BMF announcement of 1.6.2017).

Compared to the previous legal situation, the step-by-step calculation method results in a lower overall reasonable burden, which is deducted from the extraordinary burdens claimed. As a result, this calculation can lead to a higher tax deduction of extraordinary burdens and thus to lower income tax. Although the new regulation is clearly advantageous for the taxpayer, it also complicates the calculation again. When is the "reasonable burden" reached for the taxpayer?

To help you easily determine your reasonable burden and thus the tax-effective extraordinary burdens, use the following scheme.

For all those who use Lohnsteuer kompakt for their tax return, the new step-by-step calculation method is taken into account in the tax calculation.

(2022): How to calculate the reasonable burden!

Who can claim exceptional costs?

Basically, everyone! Anyone with exceptional expenses can claim them in their tax return. This reduces the income tax payable, helping to avoid undue hardship.

If a taxpayer has unavoidable major expenses compared to other taxpayers with similar income, assets, or family status, they can apply to reduce their income tax. To do this, you must enter your exceptional expenses in the tax return.

However, only expenses that exceed a reasonable burden and are actually necessary are considered. The reasonable burden is determined by the taxpayer's income, family status, and number of children.

The percentage is between one and seven per cent of the taxable annual income. If your exceptional expenses exceed this percentage, you can claim the costs in full.

Exceptional expenses can include:

- Funeral costs,

- Care costs, or

- Medical expenses.

However, divorce costs have not been deductible since 2013 due to a change in the law!

In special cases, expenses for maintenance can be considered exceptional expenses. In this case, a reasonable burden is not applied.

The care allowance can be claimed by anyone caring for a close relative. This is an annual amount that is not dependent on a reasonable burden. You will find more detailed information on the individual pages of our tax return about the exceptional expenses you can claim.

Tip

A distinction is made between general and specific exceptional expenses. General exceptional expenses, such as medical and funeral costs, only have a tax-reducing effect once the reasonable personal burden has been exceeded.

Specific exceptional expenses are recognised in full, but usually up to fixed maximum amounts. These include, for example, maintenance for a dependent person or the accommodation of an adult child away from home for education.

(2022): Who can claim exceptional costs?

Divorce costs no longer tax deductible from 2013

"Till death do us part?" Not quite. Around one in three marriages in Germany ends prematurely. Each time, this involves significant costs for both parties. Each spouse faces the question of whether they can deduct their divorce costs as extraordinary burdens to reduce tax. A distinction must be made between the costs of the divorce proceedings and the consequential matters.

- Until 2012, legal and court costs of a divorce could be deducted as extraordinary burdens - at least those for the actual divorce and pension rights adjustment.

- However, from 2013, the tax authorities no longer want to recognise divorce costs as tax-reducing - neither for the consequential matters nor for the actual divorce and pension rights adjustment. Allegedly due to a change in the law. The law now states that legal costs are generally excluded from deduction and are only exceptionally recognised for tax purposes "if the taxpayer would risk losing their livelihood and being unable to meet their basic needs in the usual manner" (§ 33 para. 2 sentence 4 EStG).

- Since 2013, the official instructions for the income tax return state: "Legal costs are no longer deductible as extraordinary burdens from 2013... The prohibition on deduction also applies to the costs of divorce / annulment of a civil partnership."

- Several tax courts have recognised divorce costs as extraordinary burdens even after the new regulation of § 33 para. 2 sentence 4 EStG from 2013. The legislator only wanted to restrict the taxpayer-friendly BFH ruling from 2011 and restore the old legal situation. This is evident from a statement by the Bundesrat in the legislative process, which aimed to limit the recognition of legal costs to the "previous narrow framework". This always included the direct costs of a divorce process (FG Rheinland-Pfalz of 16.10.2014, 4 K 1976/14; FG Münster of 21.11.2014, 4 K 1829/14 E; FG Münster of 19.6.2015, 1 V 795/15 E; FG Cologne of 13.1.2016, 14 K 1861/15).

The Federal Fiscal Court has now clarified the legal uncertainty and agonising doubt as to whether divorce costs are tax-deductible from 2013 - unfortunately to the detriment of taxpayers:

From 2013, divorce costs are indeed no longer deductible as extraordinary burdens according to § 33 EStG. "Because a taxpayer regularly incurs the expenses for divorce proceedings not to secure their livelihood and basic needs" (BFH ruling of 18.5.2017, VI R 9/16).

- Since the amendment of § 33 EStG in 2013, expenses for legal proceedings (legal costs) are generally excluded from deduction as extraordinary burdens. According to § 33 para. 2 sentence 4 EStG, the prohibition on deduction does not apply if the taxpayer would risk losing their livelihood and being unable to meet their basic needs in the usual manner without the expenses.

- According to the BFH, the costs of divorce proceedings are regularly not incurred to secure the livelihood and basic needs. This can only be assumed if the taxpayer's economic livelihood is threatened. Such existential concern does not apply to divorce costs, even if remaining in the marriage would severely impair the taxpayer's life.

- Although the BFH considered divorce costs as extraordinary burdens until the amendment of § 33 EStG in 2013, this is no longer possible under the new regulation. The legislator intended to reduce the tax relevance of legal costs to a narrow framework and deliberately exclude divorce costs from deduction as extraordinary burdens.

Hinweis

Following this decision, legal costs related to a divorce are no longer tax-deductible: neither for consequential matters, e.g. post-marital maintenance, child matters, gain adjustment and asset settlement (as before), nor since 2013 for the actual divorce and pension rights adjustment.

BUT: The Münster Tax Court recently ruled that legal costs to obtain post-marital maintenance are deductible as income-related expenses if the maintenance recipient taxes the maintenance payments as other income according to § 22 no. 1a EStG (FG Münster of 3.12.2019, 1 K 494/18 E).

The case: The claimant and her now-divorced husband separated in 2012. They conducted family court proceedings at the district court, which included the divorce, pension rights adjustment, and post-marital maintenance. In 2014, the marriage was dissolved by the district court, and the claimant's former husband was ordered to make monthly maintenance payments. The woman sued for higher monthly payments against the district court's decision. In 2015, a court settlement was reached on the maintenance amount. In her 2015 income tax return, the claimant declared other income in the amount of the maintenance payments received and claimed the legal costs (court and legal fees) as tax-reducing. The tax office refused to consider them.

According to the judges, the maintenance recipient's legal costs are to be considered as income-related expenses because she taxed the maintenance payments from her ex-husband according to § 22 no. 1a EStG. The woman incurred the legal costs to receive (higher) income in the form of maintenance payments in the future. The maintenance payments are to be treated as taxable income according to § 22 no. 1a EStG because the ex-husband, as the payer, had the option to deduct his maintenance payments as special expenses according to § 10 para. 1a EStG, so-called real splitting. The maintenance payments are thus fully equated with other income. This means that a full deduction of income-related expenses must also be possible.

(2022): Divorce costs no longer tax deductible from 2013

Are divorce costs tax deductible?

The costs of a divorce, particularly legal and court fees, were deductible as general extraordinary expenses under § 33 EStG until 2012. Specifically, only the expenses for the actual divorce proceedings and pension rights adjustment were deductible, not for ancillary divorce matters outside the compulsory joint proceedings. This includes disputes over joint assets, spousal and child maintenance arrangements, and decisions on parental access and custody rights.

However, since 2013, divorce costs are no longer deductible as extraordinary expenses due to a change in the law and a clarifying BFH ruling. "A taxpayer does not regularly incur expenses for divorce proceedings to secure their livelihood and essential needs" (BFH ruling of 18.5.2017, VI R 9/16).

- Due to a change in the law in 2013, expenses for legal proceedings (legal costs) are generally excluded from deduction as extraordinary expenses. The prohibition on deduction does not apply "if the taxpayer would risk losing their livelihood and being unable to meet their essential needs in the usual manner without the expenses" (§ 33 para. 2 sentence 4 EStG).

- According to the BFH, the costs of divorce proceedings are not regularly incurred to secure the taxpayer's livelihood and essential needs. This can only be assumed if the taxpayer's economic livelihood is threatened. Such existential impact does not apply to divorce costs, even if remaining in the marriage would significantly impair the taxpayer's life.

- Since 2013, the official instructions for the income tax return state: "Legal costs are no longer deductible as extraordinary expenses from 2013... The prohibition on deduction also applies to the costs of divorce/dissolution of a civil partnership."

Conclusion

Under the new legal situation since 2013, legal costs related to a divorce are no longer tax-deductible: neither for ancillary divorce matters, e.g. post-marital maintenance, child matters, equalisation of accrued gains and asset disputes (as before), nor for the actual divorce proceedings including pension rights adjustment.

BUT: The Münster Finance Court recently ruled that legal costs to obtain post-marital maintenance are deductible as income-related expenses if the maintenance recipient taxes the maintenance payments as other income under § 22 No. 1a EStG (FG Münster of 3.12.2019, 1 K 494/18 E).

The case: The claimant and her now ex-husband separated in 2012. They conducted family court proceedings at the district court, which included the divorce, pension rights adjustment, and post-marital maintenance. In 2014, the marriage was dissolved by court order, and the claimant's former husband was ordered to make monthly maintenance payments. The woman sued for higher monthly payments against the district court's decision. In 2015, a court settlement was reached regarding the maintenance amount. In her 2015 income tax return, the claimant declared other income in the amount of the maintenance payments received and claimed the legal costs (court and legal fees) as tax-reducing. The tax office rejected the claim.

The judges ruled that the legal costs should be considered as income-related expenses for the maintenance recipient because she taxed the maintenance payments from her ex-husband under § 22 No. 1a EStG. The woman incurred the legal costs to secure future (higher) income in the form of maintenance payments. The maintenance payments are to be treated as taxable income under § 22 No. 1a EStG because the ex-husband, as the payer, had the option to deduct his maintenance payments as special expenses under § 10 para. 1a EStG, known as real splitting. The maintenance payments are thus fully equated with other income. Consequently, a full deduction of income-related expenses must also be possible.

(2022): Are divorce costs tax deductible?

Who can claim medical expenses as exceptional costs?

Anyone who can provide evidence of medical expenses can also declare them in their tax return. You will need a receipt, an invoice and, in some cases, a medical certificate. It does not matter whether you incur the expense for your own illness, for your spouse's illness, or for a child for whom you are entitled to child benefit. What counts is the date you paid the invoice, not the date it was due.

Wegeunfall

If you have medical expenses related to a commuting accident or a work accident, you should declare them as income-related expenses or business expenses. This also applies to costs incurred due to an occupational illness or retraining due to illness. The advantage is that in this case a reasonable burden is not applied.

(2022): Who can claim medical expenses as exceptional costs?

Who can provide details of exceptional expenses?

Those with exceptional expenses can claim them in their tax return. These expenses reduce the income tax payable, helping to avoid undue hardship.

Exceptional expenses of a general nature (§ 33 EStG) include: funeral costs (after deduction of the inheritance), medical expenses, costs for pregnancy and childbirth or in certain cases, expenses for damage to house or flat (e.g. in the event of floods and other natural disasters). In special cases, expenses for maintenance or employing household help may also be considered exceptional expenses.

For exceptional expenses under § 33 EStG, the law expects each taxpayer to bear a share of the costs themselves. Therefore, only expenses that exceed a reasonable burden and are actually necessary are taken into account. Insurance reimbursements must also be offset.

(2022): Who can provide details of exceptional expenses?

To what extent can I claim exceptional expenses?

Here you can enter the actual expenses. However, these will not be fully recognised, as your reasonable personal contribution will be deducted. This is based on your income, marital status, and number of children and is calculated by the tax office. The reasonable personal contribution is between one and seven percent of total income. In any case, you should be able to prove the relevant expenses.

If your expenses are below the reasonable personal contribution, it is not worth declaring the costs in the tax return.

Care allowance:

If the care-related expenses are still higher than the care allowance after deducting the personal contribution, enter your care expenses as they actually occurred. However, you must then also be able to prove individually what you spent money on. However, in this way, you can claim more than the care allowance.

Tip

For the tax office, it does not matter when the costs were incurred, but when you paid them. So you should try to consolidate several expense items into one year to increase the total expenses and thus exceed the limit of your reasonable personal contribution.

Is there a large dental bill due, but not until next year? However, if you could already book other expenses under extraordinary burdens for the current year, ask your dentist for an early invoice or a partial invoice. This way, you may be able to claim all expenses that exceed the reasonable burden in the tax return for the current year.

Important

The reasonable burden is only deducted for general extraordinary burdens. Expenses listed under special extraordinary burdens remain uncut.

You can use this table to roughly calculate your reasonable personal contribution:

(2022): To what extent can I claim exceptional expenses?

How is the reasonable burden calculated?

The reasonable burden depends on the amount of your income, the number of children, and your marital status. It is automatically calculated by the tax office.

Until May 2017, the tax offices calculated as follows, which later proved to be incorrect:

A reasonableness limit is measured in three stages (Stage 1 up to 15.340 Euro, Stage 2 up to 51.130 Euro, Stage 3 over 51.130 Euro) based on a certain percentage of the "total income". This percentage is between 1 and 7 %, depending on marital status and number of children. According to previous legal regulations, the total reasonable burden was determined by the higher percentage once the total income exceeded one of the above limits. The higher percentage was then applied to the "total income".

Example

Mr Stenzel is married, has two children and a total income of 60.000 Euro. For a spa treatment, he has to pay 4.000 Euro after reimbursement from the health insurance.

Deductible as extraordinary expenses: 4.000 Euro

The reasonable burden is: 4 % of 60.000 Euro = 2,400 Euro

Tax-reducing effect: 4.000 Euro - 2.400 Euro = 1.600 Euro

Since June 2017, a new multi-stage calculation method has applied for the calculation of the reasonable burden due to a new BFH ruling: Only the part of the total income that exceeds the respective stage limit is subject to the higher percentage. For example, the percentage for Stage 3 only applies to the portion of income exceeding 51.130 Euro. The corresponding reasonable burden is determined for each stage limit, and the amounts determined are then added together (BFH ruling of 19.1.2017, VI R 75/14).

Example

Married couple with 2 children and a total income of 60,000 Euro. Medical expenses amount to 5,000 Euro.

Deductible as extraordinary expenses: 5.000 Euro

The reasonable burden is:

- up to 15.340 Euro: 2 % 306,80 Euro

- up to 51.130 Euro: 3 % 1.073,70 Euro

- up to 60.000 Euro: 4 % 354,80 Euro

total: 1,735.30 Euro

Tax-reducing effect: 5.000 Euro - 1.735 Euro = 3.265 Euro

Advantage over previous calculation: 665 Euro

Due to the step-by-step calculation method, the total reasonable burden is lower compared to the previous legal situation, which is deducted from the claimed extraordinary expenses. As a result, this calculation can lead to a higher tax deduction of extraordinary expenses - and thus to a lower income tax. Although the new regulation is clearly advantageous for the taxpayer, it also leads to a complication in the calculation.

The Federal Ministry of Finance accepts the new BFH ruling of 19.1.2017 (VI R 75/14) - from 1.6.2017 in all still open tax cases. The change has now been taken into account in the automated issuance of income tax assessments, and the assessments for previous years have also been largely amended, as far as procedurally possible.

(2022): How is the reasonable burden calculated?

Can I also claim maintenance payments for my children here?

If you are not entitled to child benefit or allowances for your adult child, you can also claim your maintenance payments for your child in need as extraordinary expenses for the relevant months.

The maximum deductible maintenance amount in 2021 is 9,744 Euro.

(2022): Can I also claim maintenance payments for my children here?

What are exceptional costs?

Extraordinary expenses of a general nature (§ 33 EStG) include:

- Care and support services,

- Costs for residential care

- Expenses for supporting a dependent person

- Other extraordinary expenses, such as

- Medical expenses

- Expenses for aids and remedies

- Costs related to pregnancy and childbirth

- Expenses for damage to house or flat (natural disasters)

- Funeral costs

Important: For extraordinary expenses under § 33 EStG, the law expects every taxpayer to bear a share of the costs themselves. Therefore, only expenses that exceed the reasonable burden and are actually necessary are taken into account.

(2022): What are exceptional costs?