(2022)

How to calculate the reasonable burden!

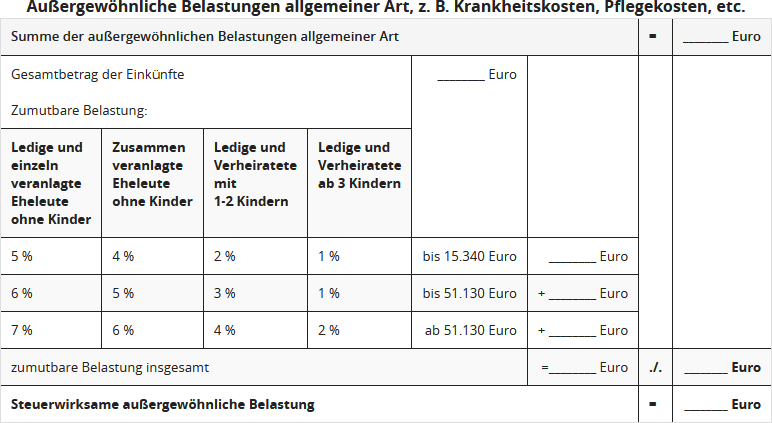

The expenses that can be deducted as extraordinary burdens are reduced by the reasonable burden, particularly medical, spa, care, and disability costs. The reasonableness limit is determined in three stages (Stage 1 up to 15,340 Euro, Stage 2 up to 51,130 Euro, Stage 3 over 51,130 Euro) based on a certain percentage of the "total income". This is between 1 and 7%, depending on family status and number of children.

- According to previous legal regulations, the total amount of the reasonable burden is determined by the higher percentage as soon as the total income exceeds one of the above limits. The higher percentage is then applied to the "total income".

- In January 2017, the Federal Fiscal Court took a closer look at the law and surprisingly found that the reasonable burden had been calculated completely incorrectly. The legally specified percentage does not refer to the "total income" but only to the part of the "total income" that exceeds the respective stage limit amount. For example, the percentage for Stage 3 only applies to the portion of income exceeding 51,130 Euro. The corresponding reasonable burden must be determined for each stage limit amount, and the amounts determined are then added together (BFH ruling of 19.1.2017, VI R 75/14).

The changed calculation method is already taken into account in the automated issuance of income tax assessments, and old assessments are also corrected if still legally permissible (BMF announcement of 1.6.2017).

Compared to the previous legal situation, the step-by-step calculation method results in a lower overall reasonable burden, which is deducted from the extraordinary burdens claimed. As a result, this calculation can lead to a higher tax deduction of extraordinary burdens and thus to lower income tax. Although the new regulation is clearly advantageous for the taxpayer, it also complicates the calculation again. When is the "reasonable burden" reached for the taxpayer?

To help you easily determine your reasonable burden and thus the tax-effective extraordinary burdens, use the following scheme.

For all those who use Lohnsteuer kompakt for their tax return, the new step-by-step calculation method is taken into account in the tax calculation.

Rechner

- Brutto-Netto-Rechner: Mit dem Brutto-Netto-Rechner von Lohnsteuer kompakt berechnen Sie, wie viel von Ihrem Bruttogehalt übrigbleibt.

- Einkommensteuer-Rechner: Sie wollen die wahrscheinliche Höhe der Einkommensteuer ganz schnell berechnen? Nutzen Sie unseren Einkommensteuer-Rechner um die aus Ihrem zu versteuernden Einkommen resultierende Steuerlast zu ermitteln.

Bewertungen des Textes: How to calculate the reasonable burden!

3.85

von 5

Anzahl an Bewertungen: 13