(2024)

What is the retirement relief amount?

The tax relief for older people can be claimed by pensioners who earn additional income or wages alongside their pension. This includes, for example:

- Income from renting,

- Capital assets,

- Income from self-employment,

- Income from private sales transactions,

- Income from a Riester pension.

Before calculating the tax relief for older people, the tax office deducts certain allowances such as the saver’s allowance and work-related expenses.

What is the amount of the tax relief for older people?

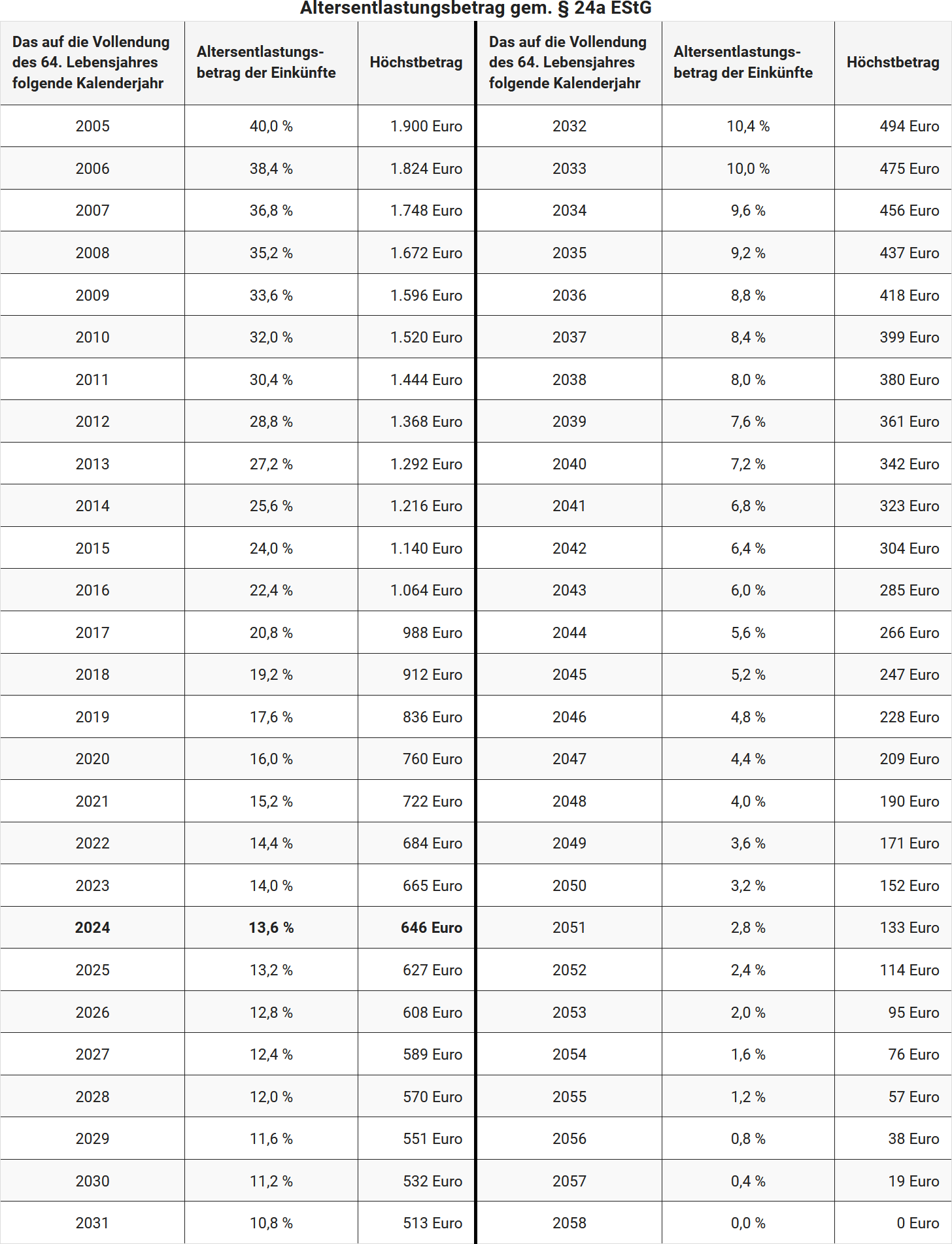

The amount of the tax relief for older people depends on the birth year of the taxpayer. The percentage of income and the maximum amount are gradually reduced. The Growth Opportunities Act has slowed this reduction from 2023. The percentage now decreases annually by only 0.4 percentage points (instead of 0.8 percentage points), and the maximum amount decreases annually by only 19 Euro (instead of 38 Euro).

Examples of the amount of the tax relief for older people:

- Born in 1958 (64th birthday in 2022): From 2023, the tax relief is 14.0% of income, up to a maximum of 665 Euro.

- Born in 1959 (64th birthday in 2023): From 2024, the tax relief is 13.6% of income, up to a maximum of 646 Euro.

- Born in 1960 (64th birthday in 2024): From 2025, the tax relief is 13.2% of income, up to a maximum of 627 Euro.

- Born in 1961 (64th birthday in 2025): From 2026, the tax relief is 12.8% of income, up to a maximum of 608 Euro.

Note on the duration of the reduction

The legal adjustment extends the duration of the reduction of the tax relief for older people until 2058. This means the amount is reduced more slowly for younger generations but remains in place for life.

Rechner

- Förderrechner Riester-Rente: Mit dem Riester-Rechner können Sie Ihre persönlichen Daten zur Riester-Rente berechnen. Der Rechner ermittelt wie hoch die verschiedenen Zulagen ausfallen und welche Höchstgrenzen für Sie relevant sind.

Bewertungen des Textes: What is the retirement relief amount?

2.50

von 5

Anzahl an Bewertungen: 2