Field help:

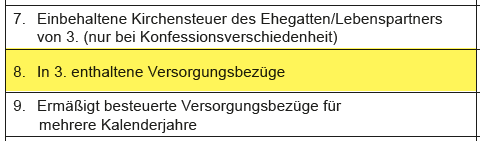

8.Pension payments included in 3.

Enter the following amount from your employment tax statement:

Number 8:

"Pension payments included in 3."

Pension payments are made, for example, to retirees (as a rule, civil servants, judges, soldiers) or pensioners with company pension rights.

Your employer has to determine whether your salary includes pension benefits and state this in the employment tax statement. Only in this case, an entry has to be made here.

In addition to the pension allowance, a supplement to the pension allowance is also granted for pension payments. There is also a flat-rate allowance for income-related expenses of more than 102 Euro unless you can claim higher income-related expenses.

You must then additionally fill in the following lines on this page:

- 29. The assessment basis for the pension allowance

- 30. The calendar year in which the pension began.

Note: If you receive several pension payments from one employer, the employer can also confirm these in line 8 (e.g. 8.1 or 8.a). The enclosed 'numbers' or 'letters' are intended to make it clear that these are data for the second certified pension payment.

If multiple current pension payments begin in the same calendar year, the employer can state the combined assessment bases of these pension payments in one amount in number 29 of the employment tax statement. This also applies to the pension payments according to line 8, which can also be summarised.