How to obtain an additional allowance for the second child!

The tax relief for single parents is 4,260 Euro and increases by 240 Euro for each additional child in the household (§ 24b EStG).

Application and reduction:

- You apply for the tax relief for single parents annually with the tax return by making the relevant entries in Lohnsteuer kompakt in the children section (Form Child).

- For employees, the tax relief for single parents can already be taken into account monthly as part of the wage tax deduction. For this, tax class II must be applied for.

- For the new increase of 240 Euro from the second child onwards, you need to do a bit more: A wage tax allowance must be entered in the electronic wage tax deduction features (ELStAM) at the tax office (§ 39a Abs. 1 Nr. 4a EStG).

Duration and changes:

- The applied wage tax allowance is valid for two calendar years. If your circumstances change, adjust the allowance (e.g., marriage or moving in together).

- After the end of the tax year, you must submit an income tax return if the amounts have already been taken into account in the wage tax deduction.

Latest decisions:

- Jointly assessed spouses can claim the relief in the year of marriage on a pro rata basis (BFH ruling of 28.10.2021, III R 57/20).

- In the year of separation, the relief can be granted for the months after the separation if individual assessment is chosen and no other adult person lives in the household (BFH ruling of 28.10.2021, III R 17/20).

The Federal Ministry of Finance currently stipulates that the rulings are to be applied generally (BMF letter of 23.11.2022, BStBl 2022 I p. 1634).

The granting of the relief requires that no other adult person lives in the household. However, there are three exceptions:

- The presence of another adult person is harmless if it is a biological child, adopted, foster, step or grandchild for whom the taxpayer is entitled to a child allowance or child benefit.

- The relief is also granted if the household member cannot actually and financially participate in the household management due to care needs.

- In 2023, the accommodation of adult refugees from Ukraine by single parents does not lead to a tax-damaging household community for reasons of equity. As a result, the entitlement to the relief remains.

How to obtain an additional allowance for the second child!

Do I receive the same amount of child benefit for all children?

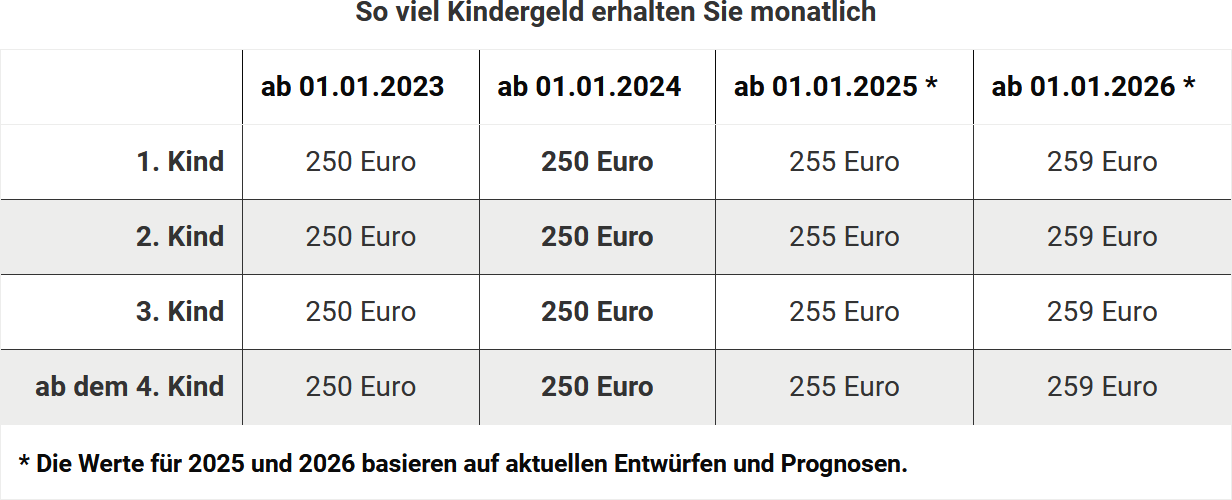

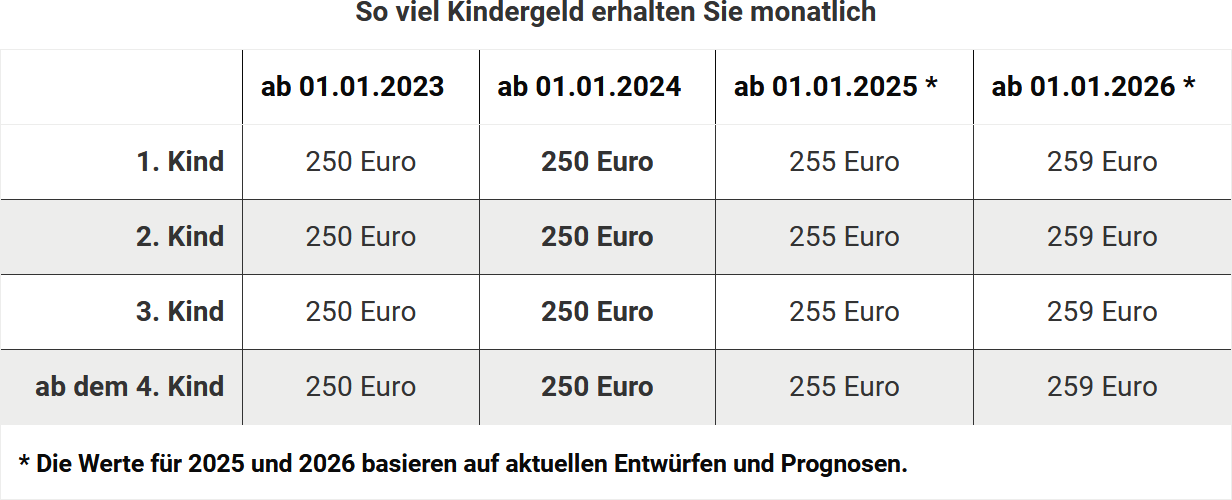

In the past, if you had multiple children, you did not receive the same amount of child benefit for each child. However, since 2023, the rate has been standardised. The entitlement to child benefit is:

Child benefit is paid for children up to the age of 18. The child's income is irrelevant.

The entitlement continues for children over 18 until their 25th birthday, as long as they are in education or doing voluntary service. Child benefit is paid by the family benefits offices of the Federal Employment Agency. Public sector employees or recipients of pension payments receive the money from their employers.

Do I receive the same amount of child benefit for all children?

What is the tax relief for single parents?

If you are a single parent, you can apply for a tax relief amount in the "Form Kind". Since 2023, the relief amount is 4,260 Euro. An additional amount of 240 Euro is added for each additional child.

For each full calendar month in which the deduction conditions are not met, the relief amount is reduced by one twelfth. Condition: at least one minor or adult child must belong to your household for whom you receive child benefit or the child allowance. It does not have to be a biological child; the relief amount is also available for an adopted, foster, step or grandchild. The child must be registered at your address. If the child is registered with several people, the parent who is entitled to child benefit receives the relief amount. The child's tax identification number must be provided.

Important: No other adult persons may belong to your household. Adult children for whom you receive child benefit are an exception. This also applies to children who are in vocational training, waiting for a training place or doing voluntary service. The relief amount is also not at risk if you live with an adult person in need of care.

Living with adults is harmless for the relief amount if there is no household community, but merely a shared flat with separate finances and separate management. A key feature of a household community is "joint management".

The Federal Fiscal Court ruled in 2021 that jointly assessed spouses can also claim the relief amount for single parents in the year of marriage on a pro rata basis. Condition: The spouses did not live in a household community with another adult person before the marriage (BFH ruling of 28.10.2021, III R 57/20).

Furthermore, the Federal Fiscal Court ruled that in the year of separation the relief amount is to be granted on a pro rata basis for the months after the separation if individual assessment is chosen and no other adult person lives in the household (BFH ruling of 28.10.2021, III R 17/20).

The Federal Ministry of Finance currently orders that the rulings are to be applied generally (BMF letter of 23.11.2022, BStBl 2022 I p. 1634).

What is the tax relief for single parents?

What is the tax relief for single parents?

The tax relief for single parents amounts to 4,260 Euro. For the second and each additional child, the amount increases by 240 Euro each (§ 24b para. 2 sentence 3 EStG).

Reduction of the relief amount:

The relief amount and the increase amount are reduced by one twelfth per month in which the conditions are not met. The condition is that you receive child benefit, the child allowance and the BEA allowance for the child.

Who is considered a single parent?

You are considered a single parent if no other adult persons live in your household, except adult children for whom you receive child benefit (e.g. children in education).

Tip:

The relief amount can also be claimed if the child only has a secondary residence with you and, for example, is studying in another city.

Application:

The relief amount is granted retroactively for the previous year if you provide the relevant information in the Form Child.

Current case law:

- The Federal Fiscal Court (BFH) has ruled that jointly assessed spouses can claim the relief amount on a pro rata basis in the year of marriage, provided no other adult person lived in the household before the marriage (BFH ruling of 28.10.2021, III R 57/20).

- In the year of separation, the relief amount is granted for the months after the separation if individual assessment is chosen and no other adult person lives in the household (BFH ruling of 28.10.2021, III R 17/20).

The Federal Ministry of Finance has instructed that these rulings be applied generally (BMF letter of 23.11.2022, BStBl 2022 I p. 1634).

Tip from 2025:

From 2025, the pro rata relief amount in the year of separation can be applied for as an income tax allowance and taken into account directly by the employer during income tax deduction. In subsequent years, the relief amount will only be granted through tax class II (§ 39a para. 1 no. 9 EStG, introduced by the "Annual Tax Act 2024").

What is the tax relief for single parents?

What are the conditions for the tax relief?

You are entitled to the relief amount if at least one minor or adult child lives in your household for whom you are entitled to child benefit or the child allowance. The tax office assumes that the child belongs to the household if the child is registered at your address with either a primary or secondary residence.

If the child is registered with several people, the relief amount goes to the person receiving the child benefit.

The allowance is only considered once, even if you have several children. Exception: If you are separated from your partner, both parties can receive the relief amount if at least one child lives with the father or mother and the child benefit is paid to them.

Single parent in relation to the relief amount means that you do not meet the conditions for the application of the splitting tariff.

The conditions for the splitting tariff are not met if the parents were not married or if they were still married in the tax year but had been permanently separated since the previous year. Parents who did not live separately for even one day in the year are therefore not actually entitled to the relief amount. You benefit from the relief amount for the first time in the year following the separation. However, please note the current legal situation.

Furthermore, as a single parent, you must not live in a household with another adult. Unless they are children for whom you receive child benefit. If you live with another adult in a household, the tax office assumes that they share the household with you. This generally applies if you live with a partner, but also for parents, grandparents, or siblings.

In the case of shared accommodation without joint household management, the entitlement to the relief amount remains. However, you must be able to prove that you manage separately. An exception is also possible if the other adult is almost penniless and cannot contribute to the household. This does not apply to partners.

The court has ruled that newly married couples can partially use the single parent relief amount in the year of their wedding, provided they did not live with another adult in the same household before the marriage. (BFH ruling of 28.10.2021, III R 57/20).

The Federal Fiscal Court has also ruled that in the year of separation, the relief amount is to be granted on a pro-rata basis for the months after the separation if individual assessment is chosen and no other adult lives in the household (BFH ruling of 28.10.2021, III R 17/20).

The Federal Ministry of Finance currently stipulates that the rulings are to be applied generally (BMF letter of 23.11.2022, BStBl 2022 I p. 1634).

Tip: There are three exceptions to the rule that no other adult may live in the household:

- If the other adult is your biological child, adopted child, foster child, stepchild, or grandchild and you receive the child allowance or child benefit for this child, it is acceptable.

- The relief amount remains if the household member cannot actually contribute to the household due to care needs.

- In 2023, the admission of adult refugees from Ukraine by single parents will not result in the loss of your entitlement to the relief amount. This is for reasons of fairness.

What are the conditions for the tax relief?

When will I receive child benefit and allowances for my child?

To receive child benefit, the child allowance or the allowance for childcare, education or training needs (BEA), the same conditions as for child benefit must be met. There are two different legal bases for entitlement to child benefit:

- Taxpayers are entitled to child benefit under the Income Tax Act (§ 31 f. and § 62 ff. EStG).

- Persons who are not or only partially subject to tax are entitled under the Federal Child Benefit Act.

Germans with a residence or habitual abode in Germany can apply for child benefit. The same applies to Germans living abroad who are either subject to unlimited income tax in Germany or are treated as such. Foreigners living in Germany can apply for child benefit if they have a permanent residence permit.

Important: Child benefit that has been approved is paid retroactively only for the last six months before the beginning of the month in which the application for child benefit was received. Therefore, even if child benefit is approved retroactively for a whole year, it is actually only paid for the last six months.

When will I receive child benefit and allowances for my child?